The global generic drugs market isn’t just surviving-it’s evolving. Once seen as a low-cost alternative to brand-name medicines, generics are now a critical backbone of healthcare systems worldwide. In 2024, they made up 57.56% of global pharmaceutical sales, even though they accounted for only about 23% of total spending in the U.S. That’s the power of affordability: generic versions of the same drug cost 80-85% less than their branded counterparts. But the future won’t be about just selling cheaper pills. It’s about adapting to complex science, shifting regulations, and new players on the global stage.

Where the Growth Is: Pharmerging Markets Are Taking Over

The old story of generics was simple: the U.S. and Europe bought them, India and China made them. That’s still true-but the real action is shifting. Countries once considered emerging markets-India, China, Brazil, Turkey, Saudi Arabia-are now driving growth. These are the so-called “pharmerging” markets, and they’re growing at nearly

10% per year, according to Mordor Intelligence. Why? Because more people are getting insured, governments are pushing for local production, and chronic diseases like diabetes and heart disease are exploding.

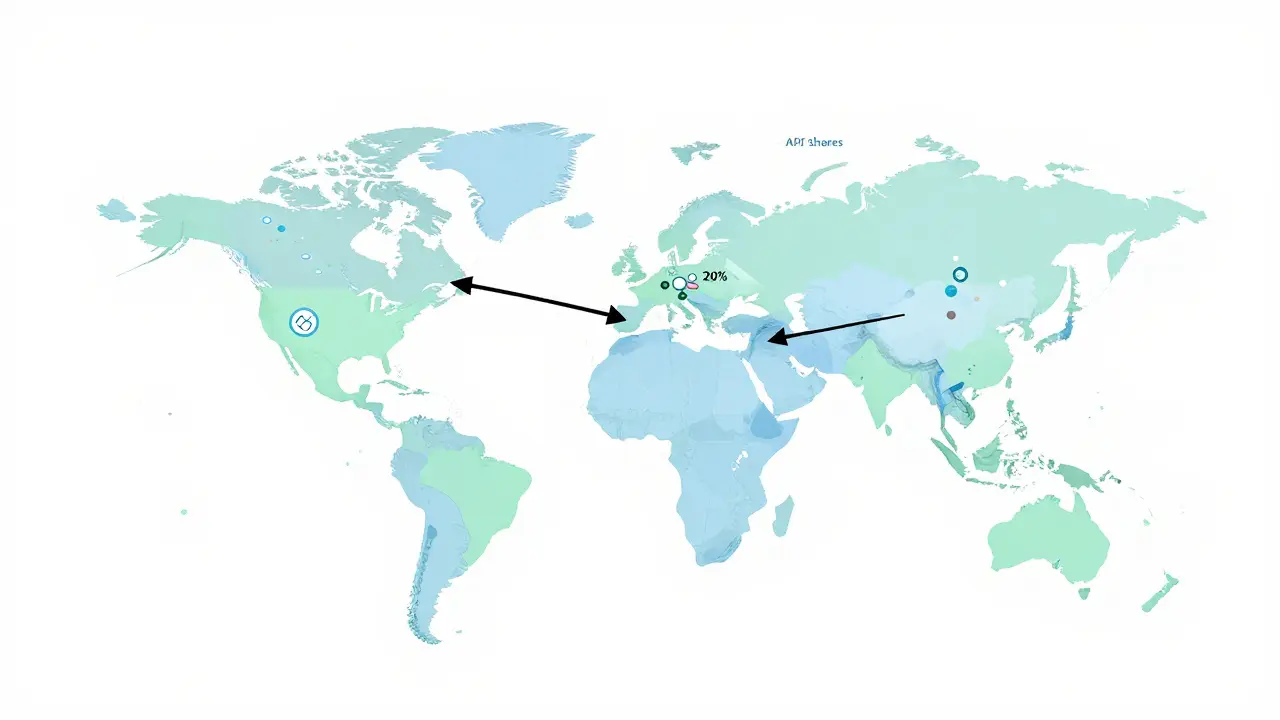

India alone produces over

60,000 generic medicines and supplies

20% of the world’s generic drug volume by volume. China doesn’t just make pills-it makes the raw ingredients. It produces about

40% of the world’s active pharmaceutical ingredients (APIs), the building blocks of every generic drug. And it’s not just about volume. Countries like Saudi Arabia are investing billions to build their own manufacturing under Vision 2030. Egypt now requires

50% of essential medicines to be made locally by 2025. This isn’t just about saving money-it’s about national security in healthcare.

Biosimilars Are the New Frontier

The easiest generics to copy are small-molecule drugs-pills you swallow, like metformin or atorvastatin. But the next wave isn’t pills. It’s biologics: complex drugs made from living cells, used to treat cancer, rheumatoid arthritis, and severe diabetes. These used to be the exclusive domain of big pharma companies like Roche and AbbVie. Now, they’re being copied-sort of. These copies are called biosimilars.

Biosimilars aren’t exact copies. They’re highly similar. And making them is a nightmare. It takes

10 to 20 times more steps than making a regular generic. Development costs?

$100-250 million instead of $1-5 million. That’s why only the biggest generic companies are jumping in. But the payoff is worth it. Biosimilars don’t cut prices by 80%. They cut them by

15-30%. That’s still huge when the original drug costs $100,000 a year. The market for biosimilars is growing at

12.3% per year-faster than any other segment in generics.

Big names like Sandoz, Mylan, and Dr. Reddy’s are racing to launch biosimilars for Humira, Enbrel, and Rituxan. The FDA approved over 40 biosimilars by 2024, and more are coming. This shift means generic manufacturers can no longer just be cheap producers. They need labs, bioreactors, and teams of scientists who understand protein folding and cell culture. The future belongs to those who can build biology, not just pills.

The Supply Chain Is a Weak Link

You might think making a pill is simple. You mix some powder, press it, and box it. But the real story starts years earlier-with raw materials. And here’s the problem: the world is dangerously dependent on two countries.

China supplies

65% of all APIs used in generic drugs. India relies on China for over half of its API needs. That’s not a partnership-it’s a vulnerability. When COVID hit, and China locked down, the world felt it. Shortages of antibiotics, blood pressure meds, and even basic painkillers hit hospitals in the U.S. and Europe. The FDA issued

187 warning letters to foreign generic manufacturers in 2023-40% of them cited quality control failures. That’s not just bad manufacturing. It’s a systemic risk.

Governments are waking up. The U.S. is funding domestic API production through the Defense Production Act. India’s PLI scheme gave

$1.34 billion in incentives to local manufacturers to make APIs and finished drugs. The EU is pushing for “strategic autonomy” in pharmaceuticals. But rebuilding supply chains takes years. Until then, the world is still gambling on a fragile pipeline.

Regulations Are Getting Tougher

In the past, you could get a generic approved in one country and sell it everywhere. Not anymore. There are now

78 different regulatory systems for drugs worldwide, according to the WHO. The FDA, EMA, and PMDA (Japan) have strict standards. But many countries still lack the resources to inspect factories or test batches properly.

That’s why quality is the biggest risk. A single contaminated batch can trigger recalls across continents. The FDA’s Center for Drug Evaluation and Research warned in 2024 that

40% of all warning letters issued went to foreign facilities. The problem isn’t fraud-it’s sloppy processes. Poor ventilation, unclean equipment, untrained staff. These aren’t scandals. They’re everyday risks.

The good news? Harmonization is happening. The International Council for Harmonisation (ICH) now includes 15 more countries since 2024. That means one set of standards for manufacturing, testing, and documentation. More countries are adopting ICH guidelines, which reduces duplication and speeds up approvals. But progress is slow. For now, generic companies must navigate a patchwork of rules-or risk losing access to the biggest markets.

Profit Margins Are Squeezed-But Not Gone

You might think generics are a race to the bottom. And for some, they are. In 2020, the average profit margin for generic manufacturers was

18%. By 2024, it had dropped to

12%. Why? Too many players, too much competition, and buyers-like pharmacy benefit managers and government health systems-using their power to drive prices down.

But here’s the twist: not all generics are equal. The low-margin ones? Those are the old, simple drugs-like amoxicillin or lisinopril. The high-margin ones? The ones that are hard to make. Biosimilars. Complex injectables. Extended-release formulations. These require technical skill, not just cheap labor. Companies that invested in R&D, automation, and quality systems are still making solid profits.

The winners aren’t the biggest. They’re the smartest. They’re the ones who stopped competing on price alone and started competing on capability. They’re building partnerships with hospitals, offering supply chain guarantees, even managing patient adherence programs. The future isn’t about being the cheapest. It’s about being the most reliable.

What’s Next? The Market Will Shrink-But Not Collapse

There’s a counterintuitive trend: while the generic drug market will keep growing in dollar value, its share of the overall pharmaceutical market is expected to drop. In 2024, generics made up

57.56% of global sales. By 2030, that could fall to

53%. Why? Because the overall market is growing faster thanks to specialty drugs-GLP-1 weight loss drugs, gene therapies, CAR-T cell treatments. These aren’t generics. They’re expensive, complex, and patent-protected.

But that doesn’t mean generics are obsolete. It means their role is changing. They’re no longer the only affordable option-they’re the

essential affordable option. While a $1,000-a-month GLP-1 drug gets headlines, millions still need insulin, statins, and antibiotics. And those won’t become expensive anytime soon.

The real winners will be those who can scale production of complex generics, ensure quality across borders, and build trust with regulators and patients. The days of the generic manufacturer as a silent supplier are over. The future belongs to those who speak up-about safety, about access, and about how to make healthcare work for everyone.

TONY ADAMS

January 26, 2026 AT 10:46Bro, generics are just fancy aspirin now. Why pay $100k for a biologic when you can get a $5 pill that kinda works? 🤷♂️

Faisal Mohamed

January 26, 2026 AT 16:27Let’s deconstruct the epistemology of pharmaceutical commodification. The hegemony of API supply chains is a neoliberal necropolitical project-China as the biopolitical substrate, India as the logistical zombie, and the West as the consumptive specter. 🌍💊 #BioCapitalism

rasna saha

January 28, 2026 AT 02:14I’m from India and I’ve seen how our factories work. It’s not perfect, but we’re trying. A lot of people rely on these meds-thank you for not making them even harder to get. 🙏

James Nicoll

January 28, 2026 AT 21:00So we’re all just waiting for the FDA to give us a hug while China makes our blood pressure pills in a basement with a fan and a prayer? Classic. 😌

Ashley Porter

January 29, 2026 AT 00:11Biosimilars are the new crypto. Everyone’s talking about them, no one really understands how they work, but somehow everyone’s investing anyway. 📈

John Wippler

January 30, 2026 AT 07:38Imagine if we treated medicine like we treat smartphones-no one would accept a $500 iPhone that only worked 60% of the time. But we’re cool with a $10,000 cancer drug that might not even reach the patient because the API got stuck in customs? We’re not broken. We’re just lazy. Let’s fix this. 💪

Kipper Pickens

January 31, 2026 AT 20:44Regulatory fragmentation is the ultimate bureaucratic jazz solo-every country improvises its own solo, but the rhythm’s always off. ICH is the metronome we keep forgetting to turn on. 🎷

Aurelie L.

February 1, 2026 AT 13:45Someone’s gonna die because a batch of metformin was made in a warehouse with mold on the walls. And then we’ll all tweet about it for a week. 🙃

Joanna Domżalska

February 3, 2026 AT 07:14Generics aren’t saving lives-they’re just delaying the inevitable. The real problem is that we treat medicine like a commodity instead of a human right. Also, your 80% cost savings are a lie. The real cost is in the side effects you don’t read about.

bella nash

February 4, 2026 AT 20:56It is imperative to acknowledge the structural deficiencies inherent in the global pharmaceutical supply chain. The absence of standardized quality assurance protocols across jurisdictions constitutes a systemic vulnerability of profound magnitude.

Geoff Miskinis

February 6, 2026 AT 02:16Of course the U.S. is funding API production-because they’re too lazy to learn Mandarin and negotiate with actual manufacturers. Meanwhile, India’s PLI scheme is just state-sponsored corporate welfare dressed up as public health policy. The real winners? The CEOs who bought the shares before the subsidies were announced. 🎩